Budget Update: How much money will New Orleans have next year?

This month the City of New Orleans had a Revenue Estimating conference. It’s the last one before an important Bond Sale this summer, and a lead-in to the 2025 Budgeting Process. Here’s what we learned, and a look ahead at the 2025 City Budget Process.

GENERAL CONTEXT: The Revenue Estimating Conference

What is a Revenue Estimating Conference?

A city's revenue estimating conference is an important meeting where city leaders and financial experts come together to predict how much money the city will have in the future.

These conferences are held because it is crucial to make accurate estimates of the city's revenue. If the city predicts it will have more money than it actually receives, it might spend too much and face financial problems. If it predicts less money than it will have, it might not spend enough on essential services. By having these meetings, city leaders aim to make the best financial plans for the benefit of everyone in the community.

The last meeting of this group was in March 2024. The next meeting will be in October 2024.

Who goes to these meetings?

The conference includes members of the administration and the City Council. They also invite other people from the City and the City’s consultants to give presentations. The meetings are open to the public. The members are:

HON. LaToya Cantrell MAYOR, CHAIR

HON. Joseph Giarrusso, COUNCILMEMBER DISTRICT A, and Budget Chair

HON. Helena Moreno, COUNCILMEMBER-AT-LARGE (NON-VOTING REP.) (absent today)

Gilbert Montaño, CHIEF ADMINISTRATIVE OFFICER

Romy S Samuel, INTERIM DIRECTOR OF FINANCE

Mara Baumgarten Force, TULANE UNIVERSITY

How much money will New Orleans have in 2025?

It depends! The City of New Orleans’ Chief Economist and the independent advising firms that they work with said to expect a lot of uncertainty (or “variance”) this year. In the meeting, experts provided estimates on the City’s 2024 revenue, which will impact this year’s budget; as well as predictions for our 2025 Revenue. There are a number of factors that impact the City’s revenue forecast:

Tax Revenue, Fines & Fees

Major events like the Superbowl, Mardi Gras, and Taylor Swift's concert in New Orleans in 2025 could increase tax revenue, while disasters like COVID or a major storm could decrease our tax revenue.

The broader economy also impacts the revenue the City can expect to take in – Factors like like unemployment rates, inflation, and GDP all have an impact on how much consumers spend. Since many economists have concerns about an oncoming recession in the US economy, the City is bracing for losses.

The City’s ability to collect revenue they’re owed - Practically, the City only gets money in the door when they’re able to process invoices and receive the money. If City staff don’t process permits, reimbursement requests, and other “receivables” in a timely manner, it can lead to delays or shortages in revenue. Since this is already a problem for the City, experts are concerned about this problem continuing in the future.

Bond Sales - This is effectively an IOU the City sells to have access to bigger pots of money. The City puts bonds up for sale for companies or individuals to buy. This gives the City upfront capital to spend on big projects. Later, the City pays back the amount with interest.

Bond rating - This is like the City’s credit score. It dictates how much money the City can borrow from creditors and at what rate. (Go deeper: Learn more about bond ratings here) Ratings range from AAA, which is the top rating, to D, which is the lowest. There are 3 credit agencies that evaluate our bond rating every quarter. New Orleans current ratings are very good:

Fitch (A, stable outlook),

Moody’s (A2, stable outlook), and

Standard and Poor’s (A+, stable outlook)

Grants, Federal and State Funding - Some of the funding the City receives is from other governments, and some is from private entities. Some of this funding is guaranteed annually (HUD is the biggest funder in this category), and some is not.

The bottom line: The City should be conservative on budgeting and spending

According to the Chief Economist and the City’s financial advisors, the City of New Orleans has spent more than they made in the first quarter of 2024, and if they keep up that trend, they could be in trouble from our credit rating agencies.

This summer, the City will sell a $200 Million bond (essentially an IOU to borrow money from investors with interest). When they do so, their bond rating will be updated. If the City looks financially unstable, their bond rating (like a credit score) will go down. This will mean it will be harder for the City to borrow money, and they will have to pay higher interest rates on money they borrow.

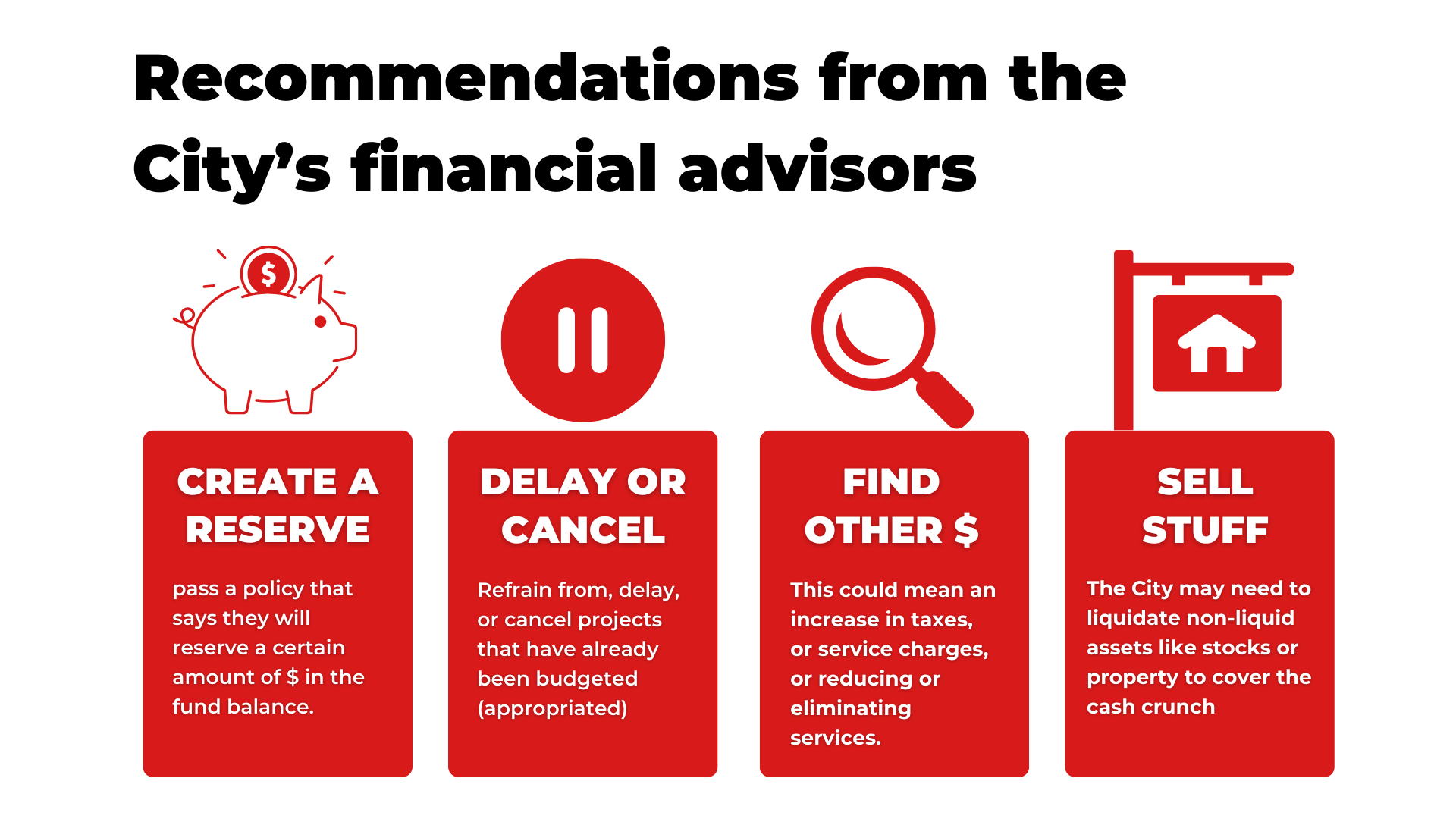

In order to keep a good credit rating, the City’s financial advisors have recommended slowing down spending their cash.

Go Deeper: Watch the meeting

Want to see the full meeting? Check out the recording here.

Just want to see the slides? Here’s the presentation by the City Economist, and here’s the presentation by the City’s Financial advisors at PFM and CLB Porter.